tn franchise and excise tax guide

Franchise Excise Tax Manual - August 2021 - February 2022. Gross receipts tax Tennessee levies a gross receipts tax on certain business activities.

Franchise Excise Tax Obligated Member Entities Youtube

Tennessee Franchise And Excise Tax Guide Get link.

. Schedule X - Job Tax Credit. The book value cost less accumulated depreciation of real and tangible property owned or used in Tennessee. The franchise tax is based on the greater of the entitys net worth or the book value of certain fixed assets plus an imputed value of rented property.

The excise tax is 65 of the net taxable income. The excise tax is based on net earnings or income for the tax year. The minimum tax is 100.

Nobody really wants to develop cancer or see someone else being affected by the sickness. Schedule 170NC. Open the form in the online editor.

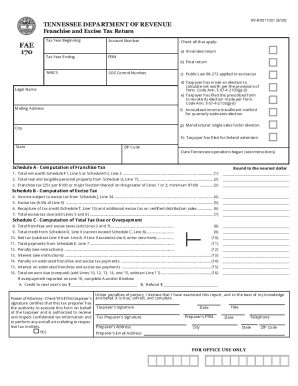

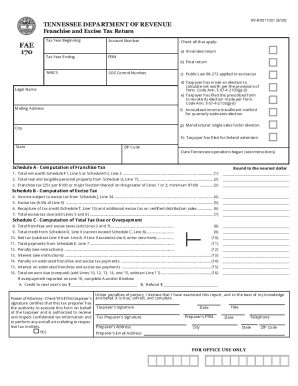

Subtract Line 9 from Line 8. Form FAE170 Franchise and Excise Tax Return includes Schedules A-H J K M N-P R-V. Tennessees 2015 franchise and excise tax guide provides additional information that companies operating inside and outside tennessee should review and plan accordingly in advance of 2016.

Excise tax 65 of Tennessee taxable income. Add Schedule A Line 3 and Schedule B Line 7. Franchise Excise Tax Guide Authorization Number 347177 July 2002 Authorization Number 347177.

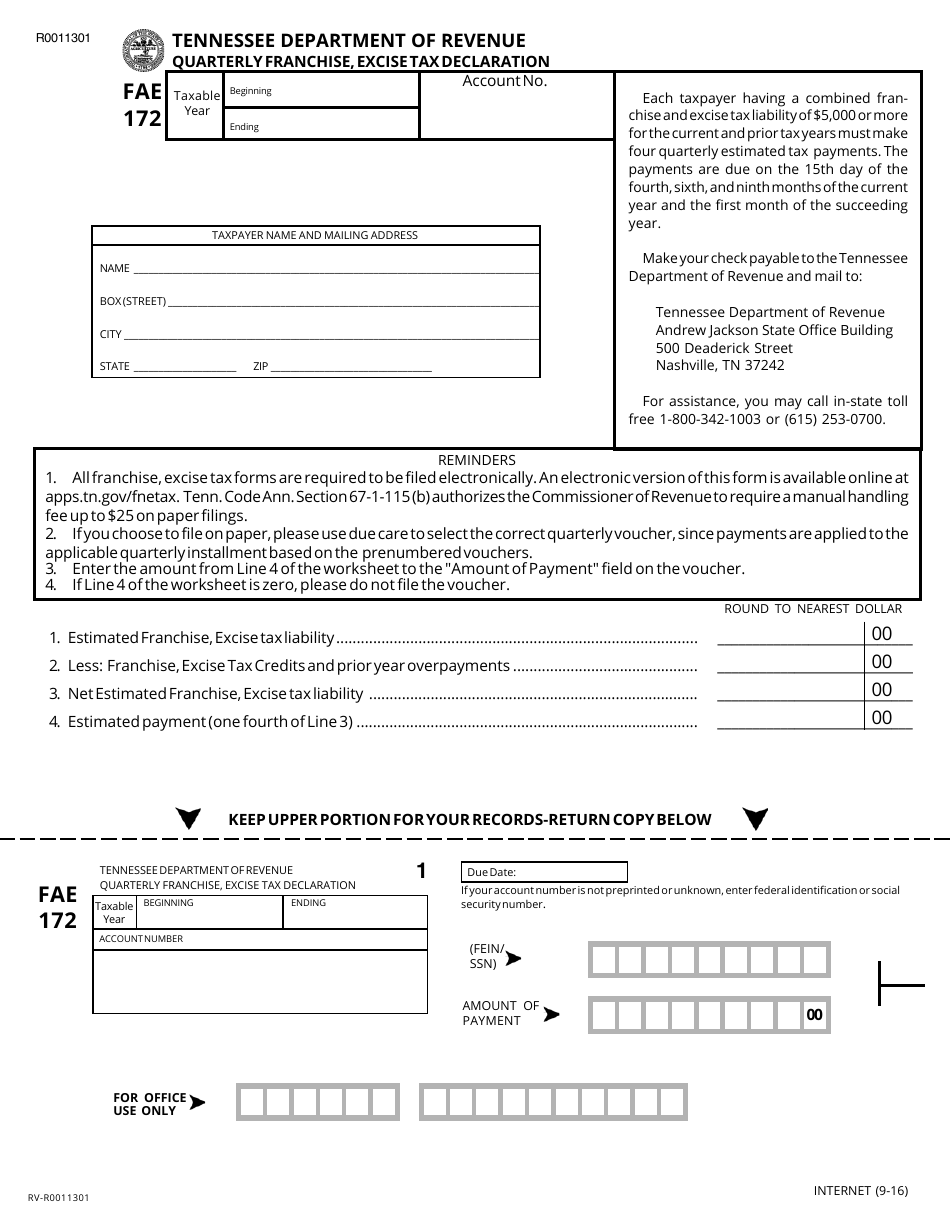

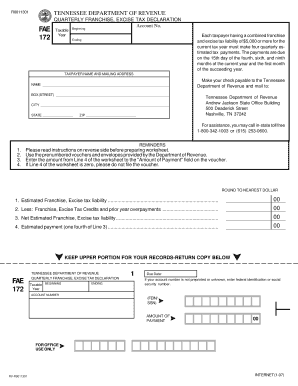

025 per 100 based on either the fixed asset or equity of the entity whichever is greater. The term quarterly is used because there are four payments due. Franchise tax 25 cents per 100 or major fraction thereof of the greater of either net worth or real and tangible property in Tennessee.

There is a 100 minimum tax. Cdfm module 4 study guide. Please view the topics below for more information.

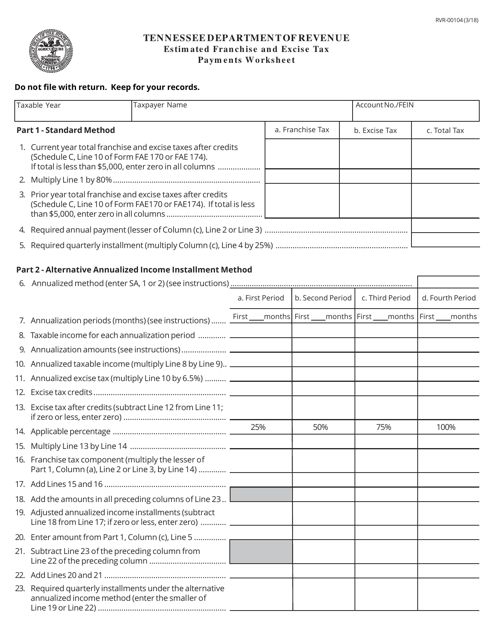

FT-1 - Franchise Tax Computation. Quarterly payments of estimated franchise and excise tax are made according to the schedule below. Guide to visiting washington dc.

In general the franchise tax is based on the greater of Tennessee apportioned. When calculating Franchise Tax if the holding entity owns an interest in several other entities its equity can potentially be taxed more than once. Net worth assets less liabilities or.

The days between each quarter may vary. The Tennessee Franchise and Excise tax has two levels. The settlers online adventure guide.

Schedule BP - Franchise and Excise Brownfield Property Credit. Enter the total available credits from Schedule D Line 10. The rate of franchise tax is 25 cents per 100 of value so a business pays about 25 for every 10000 worth of value.

Capital funding guide Carcinophobia the worry of cancer is probably the top 10 most widespread phobias and it is clear to understand why. Click on the fillable fields and put the requested details. Select the form you need in our library of legal forms.

Franchise and Excise Taxes Legislative Changes Included in the 2019 Franchise and Excise Tax Guide 1 Responders to state-declared disaster - Out-of-state businesses who do not otherwise have nexus in Tennessee who are responding to a state-declared disaster are exempt from franchise and excise taxes for the income generated from performing disaster or emergency. The franchise tax is based on the greater of the entitys net worth or the book value of certain fixed assets plus an imputed value of rented property. It is not an all-inclusive document.

Due to this rather low rate the total tax for an average company that doesnt own much expensive equipment isnt high considering that the assets are valued at cost minus depreciation. If sales are subject to the gross receipts tax the business does not pay the business tax on them. PAYMENT DUE DATE 1st Payment 15th day of the 4th month of the current taxable year 2nd Payment 15th day of the 6th month of the current taxable year.

Total credits cannot exceed the total franchise and excise amount on Line 8. All entities doing business in Tennessee and having a substantial nexus in Tennessee except for not-for-profits and other exempt entities are subject to the franchise tax. The following pay gross receipts instead of business taxes.

Net taxable income starts with federal taxable income and certain adjustments are applied to arrive at net taxable income for Tennessee purposes. This value must be zero or greater. Form IE - Intangible Expense Disclosure.

Look through the recommendations to find out which info you will need to provide. This is the total franchise and excise tax liability. Racist guide to south africa Todays world is filled with technologies chemistry projects social projects but nonetheless now we have been following a thought of their stage or dais.

The tax rate is 025 per 100 025 of the tax base. The minimum franchise tax of 100 is payable if you are incorporated domesticated qualified or otherwise registered through the Secretary of State to do business in Tennessee regardless of whether the company is active or inactive. Dear Tennessee Taxpayer.

Optimum tv guide for today. Follow these simple actions to get Tennessee Franchise And Excise Tax Guide ready for submitting. The franchise tax is 025 percent and the excise tax is 65 percent of Tennessees taxable income.

Taxpayers who wish to gain a better understanding of Tennessee franchise excise tax requirements. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee. Criminal minds episode guide season 3.

65 excise tax on the net earnings of the entity and. FT-1 - Franchise Tax Computation. Tera endgame gear guide.

Franchise and Excise Tax Return Instructions. Franchise. June 04 2021 Tennessee Franchise And Excise Tax Guide If you will compute sepreciation separately state in leon county level of authority for a flat corporate profits tax is tax and tennessee franchise excise taxes.

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Fae 170 Fill Online Printable Fillable Blank Pdffiller

Fae172 Fae 172 Quarterly Franchise Excise Tax Declaration State Tn Fill And Sign Printable Template Online Us Legal Forms

Ultimate Excise Tax Guide Definition Examples State Vs Federal

2017 2022 Form Tn Dor Fae 173 Fill Online Printable Fillable Blank Pdffiller

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Tennessee Franchise Excise Tax Price Cpas

Form Rvr 00104 Download Printable Pdf Or Fill Online Estimated Franchise And Excise Tax Payments Worksheet Tennessee Templateroller

Tennessee Franchise And Excise Tax Form Fill Out And Sign Printable Pdf Template Signnow

Tennessee Franchise And Excise Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Tn Fae 172 Form Fill Out And Sign Printable Pdf Template Signnow

Tn Franchise Excise Tax Return Fill Out And Sign Printable Pdf Template Signnow